Goals and Gains: Football Clubs Score with Crypto Partnerships

Welcome to Fintersection, where we explore the exciting collision of fintech trends with diverse industries! In this edition, we dive into the electrifying world of football and crypto, a partnership that's redefining fan engagement and unlocking innovative business models. ⚽

See further in Fintech with WhiteSight Radar. 🔮

Steer your course with exclusive insights and actionable intelligence on the hottest fintech themes, including Embedded Finance, Digital Banking, Open Banking, SME Lending, BaaS… and more!

WhiteSight Radar delivers actionable intelligence through in-depth reports, industry trends, and expert analysis. Become a member and stay ahead of the curve with:

✅ Emerging themes: Discover the next big fintech disruptions.

✅ Strategy Teardowns: Unpack the latest fintech strategies of leading companies like Apple, Stripe, Starling Bank, Amazon, Grab, Wise, Shopify, and more through our premium content pipeline.

✅ Industry initiatives: Stay informed on key market movements.

✅ Exclusive content & analyses: Bespoke research requests and briefing calls with our in-house experts… all just a click away!

Supercharge your Fintech IQ with WhiteSight Radar. Keep your eyes peeled… we’re launching VERY soon, putting expert fintech intel at your fingertips! 🚀

The Kickoff: Why Football Clubs and Crypto Firms are Teaming Up

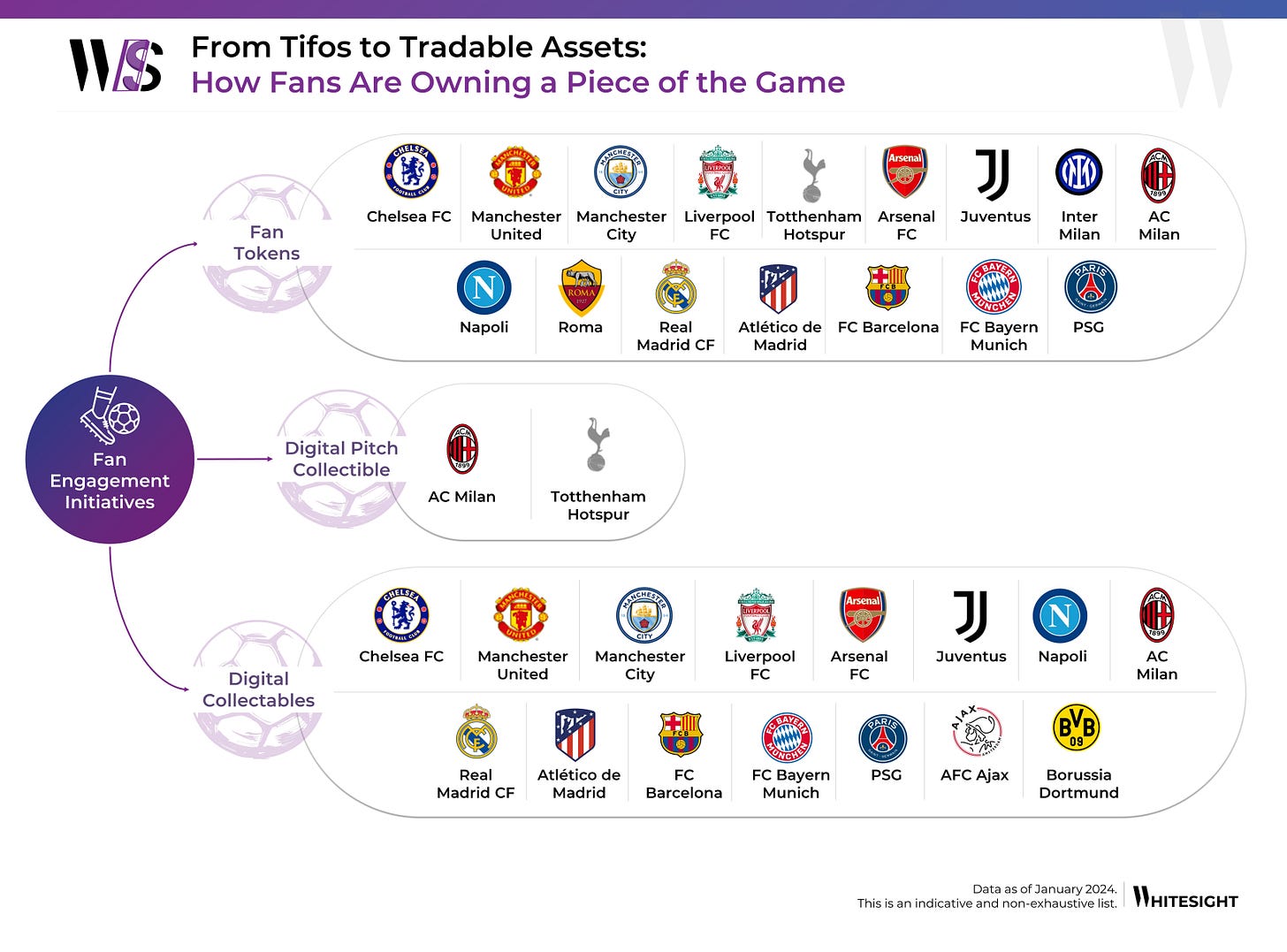

Gone are the days of simply cheering from the stands. Today, fans are craving deeper connections with their beloved clubs, seeking personalised experiences and exclusive access before, during, and after the match. This is where crypto offers a unique set of tools to transform fan engagement in the form of NFTs, Fan Tokens, Tradable cards, and ownership of virtual pitch blocks.

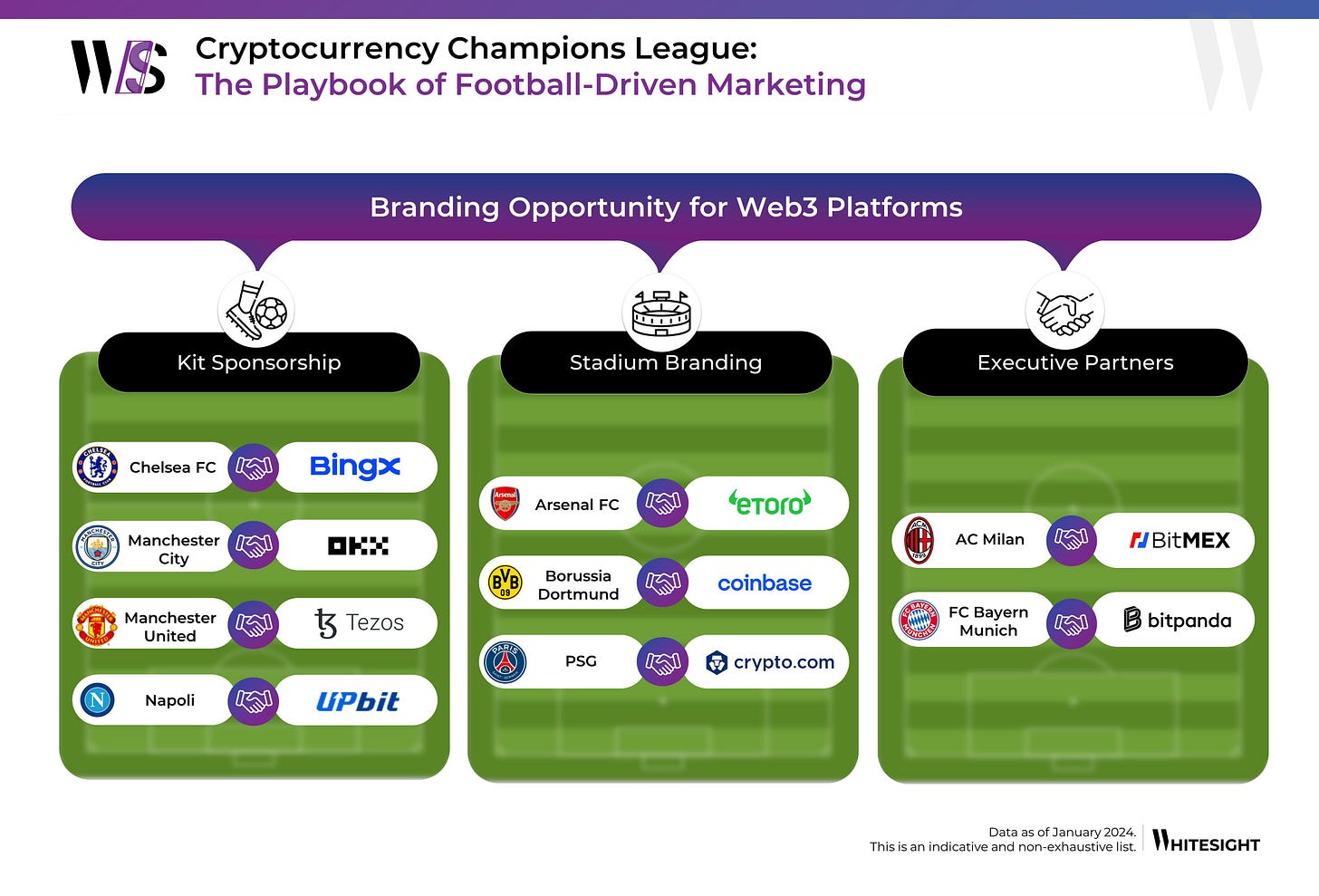

The other aspect of collaboration is more traditional - sponsorship deals. Think about it: billions glued to their screens, chanting for their heroes, united by a love for the sport. That's the kind of audience crypto companies crave, a gateway to millions eager to explore the exciting world of crypto assets. So, they're striking deals with the biggest clubs, from Manchester United to AC Milan, leveraging their jerseys, stadiums, and digital platforms to become part of the action. The clubs get a financial boost and exposure to a tech-savvy audience, while crypto companies gain instant global recognition and a chance to educate this massive fanbase.

This isn't just a fad; it's a multi-billion dollar trend expected to reach $5B by 2026. So, lace up your boots, and let's explore this alliance of football and crypto.

Patrons to partners: sponsorship through the ages

Sponsorship has transformed into a vital tool for marketing communication, assuming a pivotal role in diverse promotional strategies in recent decades. Yet, its roots stretch back over 2,500 years, originating in ancient Greece circa the 5th century BC. Initially, sponsorship emerged as financial backing from affluent individuals to support significant competitions and public festivities, showcasing their community involvement and extending influence.

In the contemporary landscape, propelled by the digital revolution and globalisation, sponsorship has evolved. Stadium signage, jersey placements, and halftime commercials are commonplace as companies vie for visibility through partnerships with esteemed teams and athletes. Brands across sectors invest staggering sums, fostering outreach and engagement. Football teams globally, long targeted by brands like Red Bull and Coca-Cola, now witness increased interest from the crypto sector, leveraging sports matches for enhanced awareness and engagement.

Loving the Fin + Everything Mix? Consider fueling our fusion explorations with a subscription! 😊🔀

Crypto transforms the football sponsorship landscape

During 2018-2022, there has been a staggering 7,100% increase in cryptocurrency sports sponsorships in sports like baseball, ice hockey, and mixed martial arts, to name a few. The value of such sponsorships by crypto companies surpassed $1.5B worldwide between January 2021 and June 2022 alone. As the Fifa World Cup kicked off in Qatar in late 2022, it was no surprise to see Crypto.com and Algorand prominently featured on the hoardings adorning the football pitch. Giants of the footballing world, including the likes of Barcelona, Bayern Munich, and Liverpool, have enthusiastically embraced partnerships with prominent crypto brands. This trend underscores the increasing recognition among top-tier clubs of the burgeoning influence and potential of the cryptocurrency space. By integrating crypto sponsors, clubs gain financial support, showcase their commitment to technological advancement in sports, and help advance the mainstream acceptance of digital assets in the sports industry.

Crypto firms leverage football's global reach

Partnerships between football clubs and crypto firms benefit both sides: clubs gain revenue while crypto firms gain exposure. Communities play a pivotal role in the crypto ecosystem's strength, evident in the growth of major coins like Bitcoin, Dogecoin, and Shiba Inu. Crypto companies recognise the significance of a robust community for marketing, attracting developers, raising capital, and increasing coin or token value. Partnerships between crypto companies and sports teams focus on three main goals:

Increasing brand visibility - Football sponsorships enable crypto companies to enhance brand visibility by associating with popular teams, tapping into their vast fan base, and gaining exposure through broadcasts, merchandise, events, and social media.

Targeting new demographics - Sponsoring football teams allows crypto companies to reach audiences beyond their typical user base, introducing digital assets to younger sports fans unfamiliar with cryptocurrencies and paving the way for mainstream acceptance.

Promoting innovation and technological advancement - Crypto companies align with football teams engaged in technological advancements to reinforce an image of progress and innovation, showcasing their technological prowess.

Beyond surface-level visibility, these collaborations encompass diverse business objectives such as influencing decision-makers, enhancing stock market value, rewarding resellers, and generating new sales. The strategy is to diversify beyond bidding for online search clicks, aiming for potential clients to naturally gravitate toward the brand in investments and crypto trading.

As noted by UEFA, the governing body of European football, the cryptocurrency sector has played a role in aiding clubs to recover lost revenue streams, especially in the post-pandemic era. This underscores the multifaceted nature of these partnerships, which extend beyond immediate financial gains to encompass strategic objectives, brand positioning, and long-term sustainability.

Beyond mere branding exercises, the utilisation of crypto in football has transcended into a tangible component of real-life transactions within the sport. In 2021, Spanish striker David Barral etched his name in football history when his transfer from Real Madrid to DUX International de Madrid was orchestrated with the payment made entirely in Bitcoin. In the same year, Rimini FC, an Italian third-division club, made headlines by becoming the first football team to be purchased using crypto. Quantocoin, a blockchain technology platform, secured a 25% stake in the Italian club, solidifying the transformative role of crypto in reshaping the dynamics of club ownership and player transactions within the beautiful game.

In a noteworthy shift within the Premier League, football clubs are bracing themselves for potential restrictions on betting companies serving as front-of-the-shirt sponsors. Amid growing concerns over the impact of gambling on society, several English clubs have proactively sought alternative partnerships with crypto companies to replace their traditional betting sponsors in a last-ditch effort to avoid a government-imposed ban. The proposed voluntary ban is anticipated to commence at the beginning of the 2025-26 season but would permit existing deals to run their course, as long as they conclude no later than the 2024-25 campaign. Numerous top Premier League clubs have either already finalised agreements or are presently in discussions with companies within the crypto sector, indicating an emerging trend.

The Next Level of Fan Engagement Through Tokens

Blockchain technology enables football clubs to leverage tokenisation to develop fan engagement programs, incentivising supporters to share content and earn rewards. These can be used for merchandise, tickets, and digital collectibles, fostering a sense of community and strengthening ties with sponsors. Its transparency facilitates seamless data sharing with advertisers, enhancing the fan experience and sponsors' ROI, ultimately modernising interactions and fostering mutually beneficial relationships among clubs, fans, and sponsors.

Fan tokens have emerged as a significant phenomenon, gaining popularity as specialised digital assets that enable interaction between sports clubs and their supporters. These tokens, tied to specific teams or leagues, empower fans by providing them with unique benefits such as voting on club matters, purchasing tickets, enjoying discounts on merchandise, and actively participating in the fan community.

Functioning as a type of utility token on the blockchain, fan tokens are distinct from traditional cryptocurrencies like Bitcoin or Ethereum. Instead, their value is derived from the fans' desire to engage with and contribute to their favourite teams. Fans can acquire these tokens using fiat currencies, such as dollars, pounds, or euros, and leverage them within a club's ecosystem to access exclusive content, voting platforms, and other fan-centric activities. Unlike non-fungible tokens (NFTs), fan tokens are interchangeable, allowing for seamless exchanges within the specific fan token ecosystem.

The pricing mechanism of these fan tokens is typically determined by the demand-supply dynamics and is susceptible to shifts based on market dynamics and the token's current popularity. Functioning akin to stocks of football clubs, fan tokens mirror the ebbs and flows of stock values. The volatility of fan tokens can, at times, surpass that of traditional stocks, contributing to significant gains for crypto holders. The oscillation in token prices aligns with broader trends in the cryptocurrency market – a positive market sentiment generally uplifts football club tokens, while a downturn has the opposite effect. Notably, the success of the club and its players significantly impacts token values. For instance, FC Barcelona's crypto asset saw a surge in early 2021, reaching $50 from an initial value of $7, propelled by successes. Despite a boost after winning the Copa del Rey, elimination from the Champions League (Dec 8th, 2021) and poor performance in La Liga led to a decline (below $10). Unlike stocks, fan tokens don’t promise to directly yield financial returns but offer privileges such as exclusive perks and the ability to participate in decision-making through voting. However, the tradable nature of these fan tokens does come with financial benefits and risks linked with the token value on the exchange.

Fan tokens might not give fans full decision-making power like governance tokens do, but letting them vote on club matters is a big step towards empowering the community. Fan tokens also empower holders to participate in various club-related activities, including voting on content shared on social media, choosing merchandise designs, and even influencing match locations. For example, in December 2020, PSG token holders could vote on the message on the captain’s armband (the choice was: “ICI C’EST PARIS”). At Juventus, it was up to the token owners to decide which songs should play as the victory anthem. They chose two pieces of music by the British band Blur. With such and other votes, the supporters of their club have the opportunity to actively influence the external image of the team and put their own stamp on it.

The success of fan tokens is evident in their adoption levels, with major football clubs like FC Barcelona and Paris Saint-Germain generating substantial revenue through token sales. When Paris Saint-Germain signed Lionel Messi, the salary package included something previously unheard of for a player -- a one-off payment, understood to be worth around €1M ($1.15M), made in PSG 'fan tokens'. It was the result of a partnership signed by the French giants in 2018 with Socios.com.

Socios: The force behind fan tokens

Socios is a key player in the fan token realm, partnering with football clubs to offer fan tokens through its website and app. When football clubs launch a new fan token, it hosts Initial Fan Token Sales (FTOs) using Chiliz (CHZ) as the digital currency, allowing fans to participate in club activities and earn rewards. CHZ is an ERC-20 token that runs on an Ethereum-based Chiliz blockchain.

To participate in the FTO, individuals sign up on Socios or download the app, register, and purchase Chiliz. The cryptocurrency can be obtained from platforms such as Binance, Coinbase, or directly through the Socios app. Users deposit fiat currencies on the app, convert them into CHZ, and then use them to acquire the desired fan token within the app. CHZ tokens are not only crucial for the initial fan token sale but also grant access to the Socios Locker Room, an exclusive space enticing new club entries. The Socios.com platform hosts the Fan Token Offering (FTO), fixing prices for fan tokens during a designated period before they enter the broader marketplace. CHZ, as the native ERC20 utility token on the Chiliz network secured by the Ethereum blockchain, serves as the digital currency for both Chiliz and Socios.com platforms. Possessing these fan tokens allows fans to participate in mobile voting and grants entry into an exclusive community of enthusiasts, providing various benefits based on the fan's token holdings and ranking.

Socios.com has gained significant recognition by securing a sponsorship deal with UEFA, the governing body of European football. With partnerships extending to 56 football clubs and around 100 sports teams globally, including PSG and Juventus, the platform has seen approximately $300M worth of coin sales via its app. Socios.com's business model involves paying clubs a minimum sum and sharing a percentage of revenue from token sales, retaining a commission of around 50%. The rest is given to the respective club. Tokens are released gradually over time, with clubs able to control voting rights based on token holder preferences. By incorporating Socios.com, clubs aim to expand their global fan bases and generate additional digital revenue in a secure and transparent manner, enhancing the authentic fan experience.

NFTs: The New Memorabilia

Football's deepening ties with crypto extend into the realm of NFTs (non-fungible tokens), marking a significant development in the sports industry. Football clubs across the globe have embraced the trend by creating their own digital assets, such as images or videos, available for purchase and trade. NFTs act as Crypto collectibles and empower teams to create unique or limited-edition items, verifiable through a secure and transparent digital ledger. Fans can acquire limited-edition player trading cards or receive rewards for assembling a complete set of team players, adding a dynamic and engaging dimension to the fan experience. Renowned football figures, including Brazil's Neymar, have actively endorsed NFTs. Juventus, in the summer of 2021, joined the NFT wave, using it as a platform for collecting memorabilia. Their inaugural NFT featured a three-dimensional, high-definition replica of the team's home shirt for the 2021/22 season, adorned with tributes to iconic players and current squad members' signatures.

While traditional trading cards and memorabilia have long been lucrative for sports teams, the emergence of a digital-native fan base, influenced by gaming and esports, necessitates a shift toward digital collectibles. Instead of static images tucked away in binders, fans have the opportunity to own a virtual block of the White Hart Lane turf or a digital corner flag from the San Siro where legends have made history. This adaptation allows clubs to align with evolving consumer preferences, fostering a broader fan base by offering digital trading cards and souvenirs that fans can effortlessly purchase and exchange.

Fan Engagement or Financial Gamble?

Partnerships between football clubs and crypto companies introduce unique challenges and risks, such as financial risk and reputational risks. It is imperative for teams to carefully evaluate these factors before engaging in such collaborations. The crypto sector, being relatively new and largely unregulated, poses unique challenges for clubs and their fans. The lack of consumer protection and the complexity of crypto investments make it challenging for sports enthusiasts to comprehend the nature of their financial involvement.

Prominent "fan engagement" services, exemplified by companies like Socios, primarily aim to incentivise the purchase of the sponsoring company's cryptocurrency. However, rather than expressing loyalty or engagement, many individuals acquire these tokens as a speculative investment opportunity, blurring the lines between sports fandom and financial speculation.

Diversified partnerships between football clubs and crypto entities extend beyond mere sponsorships. For instance, some sponsors encourage gambling with Bitcoin, while others associate with specific cryptocurrencies. The speculative nature of certain crypto assets raises concerns, likening the investment to a form of disguised gambling. This becomes especially problematic for individuals susceptible to problem gambling, whom the government aims to protect through potential restrictions on gambling sponsorships.

Reputational risks arise from the association between cryptocurrencies and financial crime. Cryptocurrencies, commonly linked to the dark web and the online black market, have been involved in hacking, ransomware attacks, and tax evasion schemes. Instances like Manchester City's halted partnership with 3Key due to doubts about the company's existence and Barcelona's cancellation of a deal with Ownix due to legal issues surrounding its executives highlight the potential pitfalls of such collaborations.

Financial stability is another critical consideration, with football clubs entering partnerships with crypto firms that may lack sufficient track records or traceable ownership. Examples of collapsed crypto firms, such as Terra and IQONIQ, underscore the risks associated with sudden financial instability. Clubs face reputational damage, financial impacts, and legal battles when sponsors fail to fulfil their commitments. DigitalBits, which previously held a sponsorship position on Inter Milan's sleeves, became their primary shirt sponsor for the 2022/2023 season. In September 2021, Inter Milan unveiled a substantial three-year, €85M partnership with Zytara Labs, the entity overseeing DigitalBits. However, due to a failed payment, Inter Milan had to take measures to minimise DigitalBits' brand visibility. This includes the removal of associated marketing assets from the club's official website, billboards on the stadium sidelines, and the women's first team kit.

Moreover, the football community's commitment to environmental sustainability, as exemplified by the Premier League signing the UN Sports for Climate Action Framework, raises questions about the energy-intensive nature of certain cryptocurrencies. The substantial energy requirements for transactions and coin mining conflict with the league's goals to reduce emissions and achieve net zero by 2040.

The growing prevalence of crypto sponsorships in football has prompted the Premier League to investigate these partnerships, considering concerns raised by fan groups and regulatory bodies. Recent advertising regulator interventions, such as the ban on Arsenal's fan token promotions, emphasise the need for transparency and responsible marketing in the crypto market. The Culture, Media and Sport Committee has expressed concerns about the financial harm to supporters and reputational damage to clubs arising from volatile cryptoasset schemes promoted as fan engagement.

More Than Moneyball: Lob Pass to the Future

This tag-team partnership between crypto and football isn't just about megabucks and marketing; it's about bringing the beautiful game closer to its global audience. Imagine a teenage Messi devotee in Mumbai bidding on his signed boots with her meme-coin savings, or a football-mad kid in a remote village in Senegal owning a limited-edition NFT of Mohamed Salah – the possibilities are as endless as a Ronaldinho trickshot compilation. The beautiful game is becoming borderless, thanks to the magic of crypto, and that's a win for football fans worldwide. So, while the jury's still out on who'll score the winning goal in this ever-evolving game, one thing's for sure: the future of football is looking as bright and unpredictable as a well-timed lob pass – and crypto is right there on the pitch, boots laced and ready to play. Let's just hope the memes flowing through the cryptosphere are as entertaining as the silky skills on the field!

And It’s A Wrap! 👏

Hope you enjoyed this edition of Fintersections! Stay tuned for more interesting think-pieces in the coming months.

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

Our latest publications include:

If you're someone who likes to stay in the know of what’s happening in FinTech, you don’t want to miss out on our weekly newsletter—Future of Fintech—where we religiously track next-gen themes of the industry.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, research content, or sponsorship-related services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech, follow us on LinkedIn and Twitter and don't be shy to show some 💛