Fintersection: How Affirm is Scaling Distribution with Embedded BNPL

Think BNPL is just about checkout options? Think again.

Welcome to Fintersections, where we explore the exciting collision of fintech trends with diverse industries! In this edition, we’re diving deep into how BNPL providers are expanding their reach beyond traditional merchant checkouts, exploring new avenues like consumer platforms and SaaS solutions. Join us as we uncover the potential of this multi-pronged approach to scale BNPL - reshaping the way we shop and do business!

If you're even slightly plugged into the Fintech world, you've likely come across the buzz around BNPL and embedded finance. But have you encountered the term embedded BNPL? It's easy to see why there might be some confusion. Sure, BNPL is often about embedding financing options directly into merchant checkout platforms - either online or offline, so in a way, it does seem naturally "embedded," right? And yeah, you're not wrong.

But in this blog, we're taking a deeper dive to break down what a multi-layered approach to embedded BNPL really means. We’re not just talking about the basic financing options you see during checkout, i.e. traditional BNPL. There are more levels to how this approach to embedding BNPL with partners who have direct access to merchants and consumers. Let’s go down the rabbit hole and explore the intricacies!

Want to dive deeper into the world of Embedded Finance? Our latest report with Brankas explores the global trends shaping the BaaS landscape. Discover how BaaS is revolutionizing financial services and enabling innovative business models. Read more and download the full report:

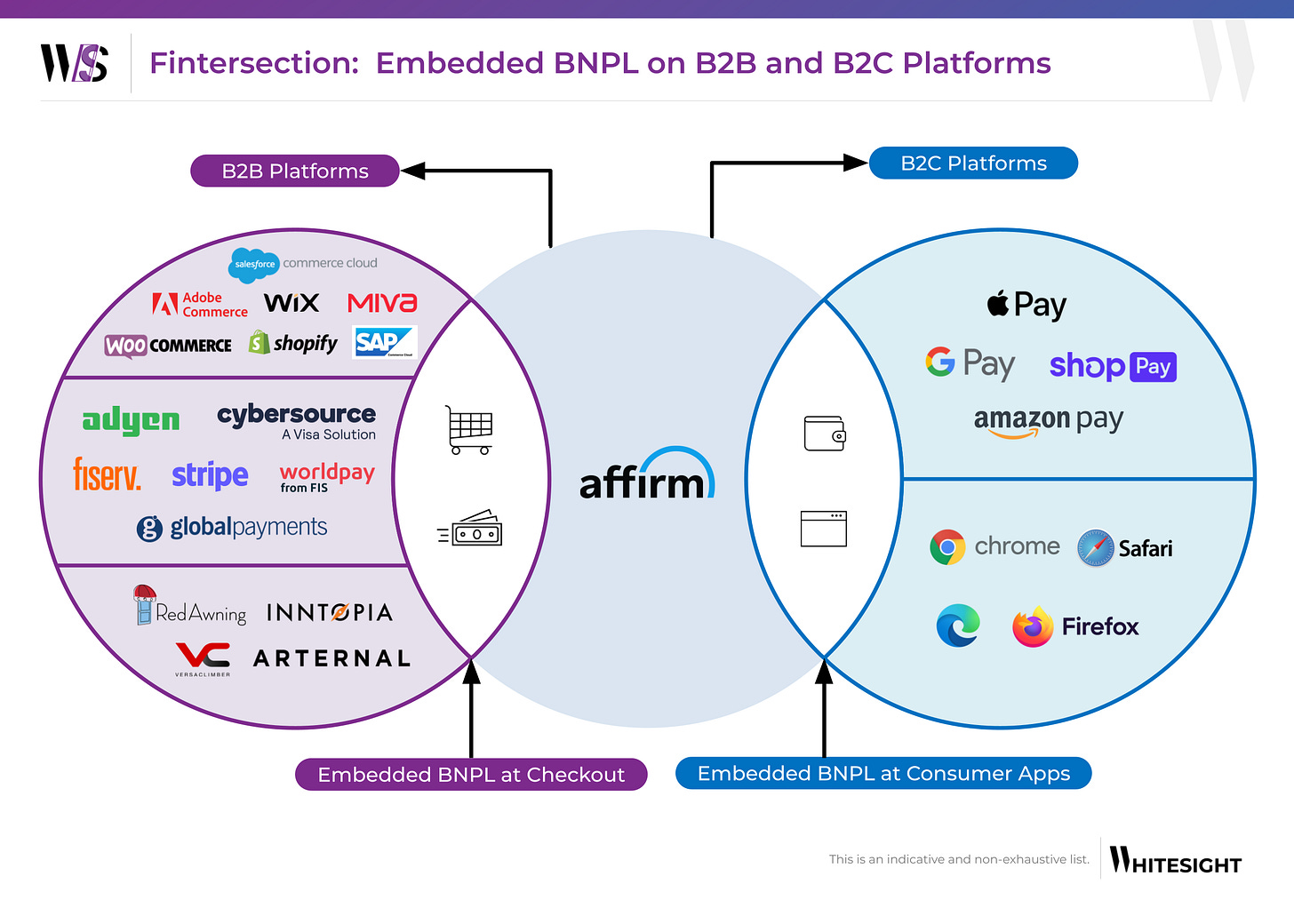

BNPL providers like Affirm are taking things a step further in embedding BNPL on multiple platforms. The new frontier includes embedded BNPL on consumer platforms and SaaS platforms used by businesses. This multi-pronged approach has the potential to exponentially scale BNPL distribution, making it a powerful force driving transactions across industries. Don't just take our word for it; check it out for yourself below!

See further in Fintech with WhiteSight Radar. 🔮

Unlock a treasure trove of fintech intel with a WhiteSight Radar subscription. See further with exclusive reports, industry trend breakdowns, and expert analysis on everything from Embedded Finance and Digital Banking to Open Finance and beyond.

Become a member and steer your business course with actionable intelligence on the winning strategies of leading companies like Apple, Stripe, Starling Bank, OakNorth Bank, and Toast that propels your business to the forefront of fintech. (PLUS! More in our premium content pipeline - Amazon, Grab, Wise, Shopify, Mercado Libre… the list goes on!)

Supercharge your Fintech IQ with WhiteSight Radar, putting expert fintech intel at your fingertips! 🧭

Let’s uncover how Affirm is taking BNPL to the next level, seamlessly weaving it into the very fabric of how consumers shop and merchants operate business online.

So, what's the big picture?

Affirm is not abandoning its traditional partnerships with merchants, both big and small. But this embedded BNPL strategy is a power move. It positions Affirm at the heart of the buying journey, reaching consumers exactly when they're making purchasing decisions. It's a strategic distribution play that could redefine how we access and utilize BNPL in the future.

Embedded BNPL: Shopping Seamlessly, Everywhere You Do Business

Imagine BNPL woven directly into the fabric of your online shopping experience. That's the magic of embedded BNPL. Instead of being a separate financing option you seek out, it's seamlessly integrated within the platforms you already use.

Here's how it works for different players:

Consumer Platforms: Think of your favorite digital wallets (Apple Pay, Google Pay, etc.) or even your browser (Chrome, Safari, etc.). Embedded BNPL means BNPL providers like Affirm partner with these platforms to offer their financing options directly at checkout. So, when you're buying that new phone, you can choose to split the payment through Affirm with just a few clicks, all within your familiar digital wallet or browser environment. No need to juggle between different apps or websites.

SMBs SaaS Platforms: This is where B2B meets BNPL. Embedded BNPL here means BNPL providers partner with the software tools many small and medium businesses (SMBs) use to run their operations. This could be a payment processor like Stripe, a B2B e-commerce platform like Shopify, or even industry-specific software like a property management platform. With embedded BNPL, these platforms can offer BNPL options directly to their customers (your business, in this case) during the checkout process. So, if you're renting an apartment, you might be able to split your rent into installments directly through the property management platform, powered by an embedded BNPL solution.

Embedded BNPL is essentially a strategic handshake between BNPL providers and the platforms consumers and businesses already use. It makes accessing BNPL financing smoother and more convenient than ever before, potentially influencing how consumers shop and manage payments across various aspects of their financial lives.

How Embedded BNPL Differs from Traditional BNPL at Checkout

Traditional BNPL at Checkout: This approach involves enabling BNPL options directly at the checkout stage through direct partnerships with both traditional and digital merchants. For instance, Affirm partners with well-known retailers like American Airlines, Cathay Pacific, and Walmart (traditional merchants) as well as online platforms like Booking.com and Expedia (digital merchants). At the point of sale, whether online or in-store, customers can choose to split their payments into installments using Affirm’s BNPL service.

Difference: The key difference lies in the point of integration. Traditional BNPL at checkout is focused on offering financing options at the final stage of the purchasing process through direct merchant partnerships. In contrast, embedded BNPL is integrated throughout the consumer’s shopping journey or within the business’s operational platforms. This seamless integration within wallets, browsers, and various SaaS platforms ensures that BNPL options are available at multiple touchpoints, not just at the final checkout stage, thus enhancing accessibility and convenience for users.

Affirm's Strategic Outlook: Scaling Distribution Through Innovative Embedding

Affirm, a leading BNPL provider, has set its sights on expanding its reach by embedding its services across a diverse array of platforms. This strategy not only enhances accessibility for consumers and businesses but also positions Affirm at the forefront of the fintech revolution. Let's delve into the specifics of Affirm's strategic moves:

Embedding BNPL on Consumer Platforms

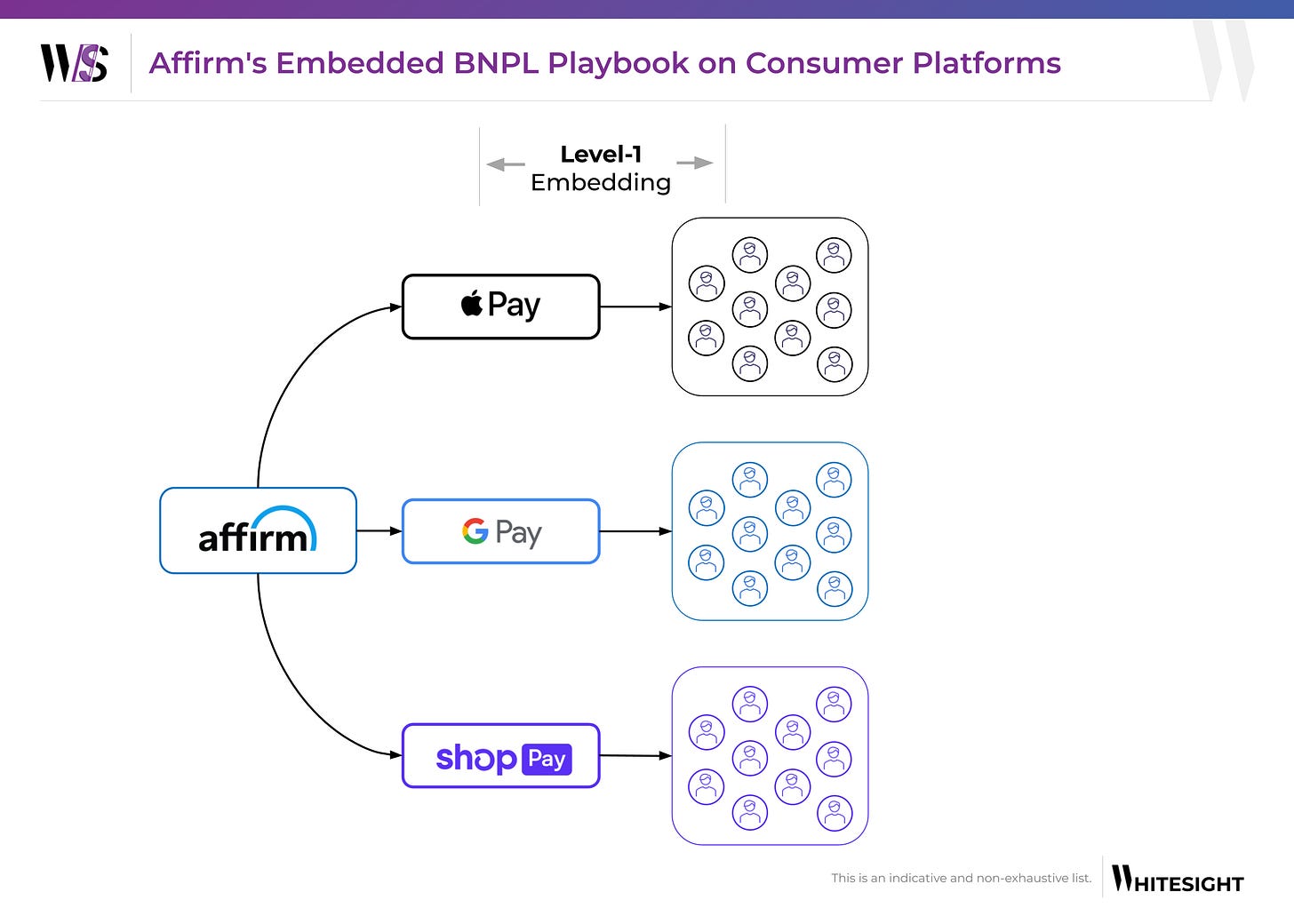

Affirm's first key strategy involves integrating BNPL options into widely used consumer platforms. This approach ensures that consumers can seamlessly access BNPL services through platforms they already trust and frequently use. The primary targets for this embedding include:

Wallets: By partnering with digital wallet providers like Apple Pay, Google Pay, Amazon Pay, and Shop Pay, Affirm can offer consumers the convenience of BNPL options directly within their preferred payment methods. This integration simplifies the purchasing process, making it easier for consumers to manage their finances and shop responsibly.

Browsers: Another innovative move is embedding BNPL services into popular web browsers such as Microsoft Edge, Chrome, Firefox, and Safari. This strategy ensures that consumers can access BNPL options while browsing the internet, enhancing their online shopping experience. It also positions Affirm as a ubiquitous presence in the digital ecosystem, increasing brand visibility and user engagement.

Embedding BNPL on SMB SaaS Platforms

Affirm's second strategic focus is on embedding BNPL solutions into Small and Medium Business (SMB) SaaS platforms. This move targets various segments within the SMB market, providing tailored solutions that meet specific business needs. Key areas of focus include:

Payment Processors: By integrating with payment processors like Stripe, Adyen, and Worldpay, Affirm can offer BNPL options at the point of sale for numerous small businesses. This partnership enhances the payment processing ecosystem, enabling SMBs to provide flexible payment options to their customers, thereby boosting sales and customer satisfaction.

B2B e-Commerce Platforms: Embedding BNPL services into B2B e-commerce platforms such as Shopify, WooCommerce, and Adobe Commerce allows Affirm to tap into the burgeoning B2B market. This integration supports businesses in offering flexible payment terms to their clients, fostering stronger commercial relationships and driving growth.

Vertical SaaS Platforms: Affirm's strategy also includes partnerships with specialized vertical SaaS platforms like RedAwning, Inntopia, and Arternal. These platforms cater to niche markets, and by embedding BNPL options, Affirm can address specific industry needs, providing tailored financial solutions that enhance business operations and customer experiences.

The future of BNPL is embedded

Affirm's innovative distribution strategy, characterized by embedding BNPL services across a wide range of consumer and SMB platforms, exemplifies the concept of Fintersection. By leveraging the synergies between fintech advancements and strategic business partnerships, Affirm is poised to redefine the BNPL landscape, offering unparalleled convenience and flexibility to consumers and businesses alike.

And It’s A Wrap! 👏

Hope you enjoyed this edition of Fintersections! Stay tuned for more interesting think-pieces in the coming months.

Hungry for more fintech insights? Check out some of our other work at WhiteSight.

Our latest publications include:

If you're someone who likes to stay in the know of what’s happening in FinTech, you don’t want to miss out on our weekly newsletter—Future of Fintech—where we religiously track next-gen themes of the industry.

Fintech research is in the WhiteSight DNA, so if you'd like to get in touch for features, research content, or sponsorship-related services, reach out to us at hello@whitesight.net.

And lastly, to stay updated on everything fintech, follow us on LinkedIn and Twitter and don't be shy to show some 💛