Banks Compounding Their Interest In The Metaverse

Welcome back to yet another edition of Fintersections. This time, we talk about a buzzword that's been causing quite a stir lately in the world of banking 一 Metaverse.

Metaverse’s booming popularity has got people hungry for a taste of virtual reality. For many, the concept is still futuristic, opening up a universe of infinite possibilities.

Wondering what Fintersections is all about? Read about it here and subscribe to stay in the loop of some monthly FinTech thought-provokers delivered straight to your inbox!

Banks have worked on the pen and paper model for centuries. The branch-centric retail-banking distribution model has largely remained the same since the days of the Medicis. Then came the internet era, and banks built bank websites by launching a web version of their branch to engage with the consumers through the web channel. Soon after, the mobile era upended the internet, and banks made attempts to transform their branch-centric websites into mobile apps. While they were busy doing that, the digital era allowed new entrants – the FinTech startups – who plugged into the core attributes of mobile and internet to reimagine the business model of banking. They reimagined the art of the possible in the banking industry by re-architecting their operating models, customer engagement processes, and financial product creation & distribution mechanisms. In the wake of the pandemic, traditional banks across the globe have realised the power and potential of digital, increasingly making digital bets to reimagine their business models from the ground up.

From Digital Transformation to Meta-Morphosis

The debate over disruptions in the banking industry has picked up steam with the success of FinTechs and the entry of non-banks and BigTechs. Traditional banks have accelerated digital transformation initiatives in response to these disruptive undercurrents. Over the years, the term has expanded to include mobile banking, data-driven decisioning, automated operations, and omnichannel engagements on digital channels through automated chatbots and voice bots. Some banks have also launched high-tech versions of their branches, such as ATB Financial’s use of Softbank Robotics’ robot Pepper as a greeter and the introduction of touch tables at State Bank of India’s InTouch branches to facilitate self-service digital interactions for customers. Meta(verse)-morphosis happens to be the latest addition to the evolutionary dimension of digital transformation in the banking industry.

The metaverse, while still in its infancy in many ways, has suddenly become a lucrative industry, with tech titans, gaming giants, and brand behemoths like Meta (formerly Facebook), Microsoft, Epic Games, Roblox, Nike, Coca-cola, and several others developing their own virtual worlds a.k.a. metaverses.

Having lagged in the digital finance race brought upon by the FinTechs and BigTechs, banks have realised the opportunity cost of missing out on emerging trends. In the case of Metaverse, forward-looking universal banks have decided to take the proverbial Red Pill to venture deep into the metaverse rabbit hole.

Banks’ New Avatar in the Metaverse Economy

The web2-era’s digital trends didn't just introduce new ways of banking – they also introduced a completely new digital economy, which included new jobs, modes of social interactions, commerce, and assets. As the immersive 3-D economy and web3 phenomenon grow over the coming decade, the metaverse is expected to do the same. It will create a metaverse economy shaped by the changes in how we work, play, interact, shop, and create and manage wealth.

According to Precedence Research, the global metaverse market was valued at around US$40B in 2021. It is projected to grow at a CAGR of 50.74% from 2022 to 2030, worth around US$1.6T by 2030. The size and exponential CAGR of the metaverse economy have banks making a beeline with compounded interest to find ways to keep themselves relevant to the crypto-enthusiast consumers, NFT-savvy brands, digital-asset hungry institutions, and AR/VR-early adopter employees. Just like in the real economy, banks are expected to play a critical role in the metaverse economy. They may launch new products, unlock new revenue streams, engage new customer segments and in the process, create a new brand identity by orchestrating new experiences for the customers and employees.

Knock, Knock Knocking On Metaverse’s Door

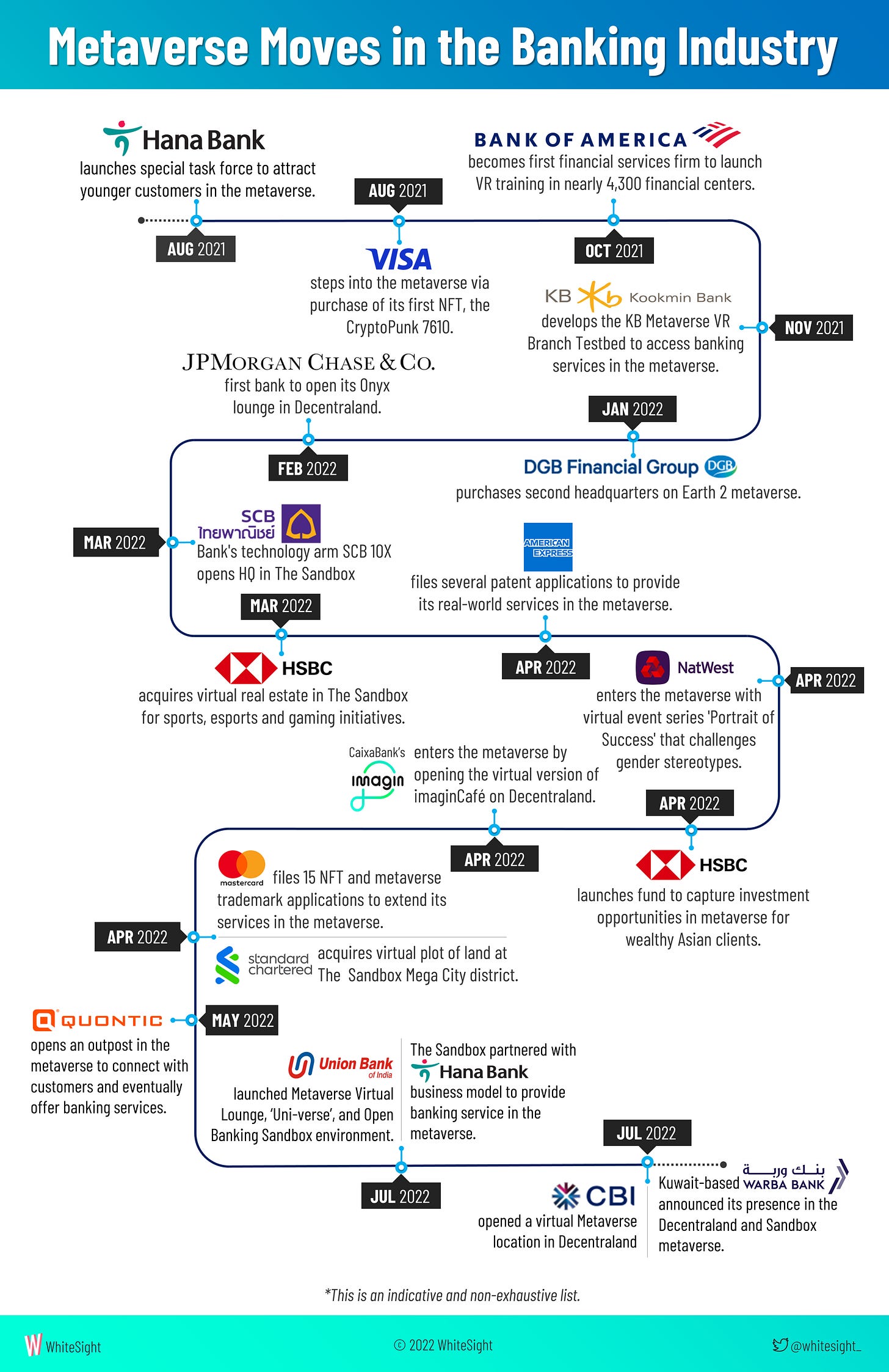

Big banks have held sway for decades, sticking to the same old-school methods of banking. But, the battlefield isn't the same today. There's a whole new generation who wants so much more when it comes to managing money. And to address the digital and contextual needs of this emerging but demanding generation, banks are now beginning to venture into the metaverse. Since this world is tied to NFTs, cryptos, and thus, to the Millennials & Gen Z, banks are racking up deals to hook the younger generation. As shown in the exhibit below, several banks from the US, South Korea, Europe, Middle East, and Asia pacific have embarked upon their Metaverse odysseys.

Multi-trillions in the Metaverse

The doors of Metaverse have been rung by dozens of celebrities and brands lately. It seems like everyone wants to date this sensation. The desire to sit front-row is widespread, but FOMO is also a driving force behind some. The banks aren't far behind in this trend either. We have seen an influx of so many banks into this new world since 2021.

Banks' excitement about the metaverse doesn’t just lie in the trillion-dollar size of the metaverse economy but also stems from their beliefs that the metaverse will emerge as a futuristic destination for commerce, employment, entertainment, and social activities.

“The metaverse is a seamless convergence of our physical and digital lives, creating a unified, virtual community where we can work, play, relax, transact and socialize.” – J.P.Morgan

“We believe the Metaverse is the next generation of the internet — combining the physical and digital world in a persistent and immersive manner — and not purely a Virtual Reality world.” – Citi.

“Metaverse is expected to become the next iteration of the internet.” – HSBC

Marking Territories in the Metaverse

Thanks to the efforts of the FinTechs and BigTechs, banking is already at our fingertips via mobile phones. So, how will banks use the metaverse now to do something new and different?

Well, their numerous activities in the space can be broadly divided into three categories:

Plot Purchase

As with any physical bank branch, which begins with the purchase of a plot and the subsequent establishment of a branch, the metaverse works in a similar fashion. The only difference? The “land” is virtual and usually bought in Decentraland or The Sandbox.

One of the first names to take this step was JPMorgan. The company, in February 2022, entered the metaverse with the opening of its Onyx lounge (with the key highlight of a roaming tiger) in blockchain-based Decentraland. Several banks were hot on their heels to join in the metamorphosis bandwagon soon after. In March, HSBC ventured into the metaverse, acquiring virtual real estate in The Sandbox, where it plans to engage and connect with sports, esports, and gaming aficionados. A month later, in April, Standard Chartered upped its game and acquired a virtual plot of land at The Sandbox metaverse’s Mega City district, a culture hub inspired by Hong Kong creative artists. Next, Imagin, an offshoot of CaixaBank, became the first European FinTech to go meta. Imagin’s metaverse journey kicks off with a virtual replica of imaginCafé, the company's physical space in downtown Barcelona, where users can access content on culture, creativity, technology, and sustainability.

Metaverse isn't just for the first worlds anymore. Growing nations like India have boarded the meta spaceship as well, with headlines of banks getting into metaverse having made considerable waves in the country. Union Bank of India launched Open Banking Sandbox Uni-verse to work with Fintechs and start-up partners to develop and launch innovative Banking products.

The Middle East appears to be another hub accepting the novel era of metaverse banking – notable names in the region, including Commercial Bank International, a UAE-based corporate and retail bank, became one of the first banks in the region to open a virtual Metaverse location in Decentraland, keeping up with a digitally driven economy and reinventing customer experiences are essential to business success.

Another renowned name – Warba Bank – a Kuwait-based Islamic bank, recently became the latest corporation to enter the metaverse. The bank now occupies two sites in the metaverse, one Decentraland and another on Sandbox.

The Exhibit below provides a detailed timeline of the companies and their activities in the metaverse:

Technology Trademarks

As mentioned earlier, the metaverse is an emerging phenomenon with the potential to evolve as a futuristic destination for various commercial, social, and economic activities. Financial institutions have an opportunity to provide the infrastructure and technology tools where these activities are performed seamlessly and securely.

Realising this potential, a number of the biggest payment networks like Mastercard and Visa are doubling down on blockchain and NFT bets. In fact, Mastercard is well-known to be a prominent force behind crypto, with investments in dozens of companies, from Coinbase, CoinDesk, and Kraken to Lightning Labs, Circle, Ripple, and Grayscale. These organisations have taken many actions to remain competitive within the virtual economy. While Mastercard created a three-month program called Start Path Crypto to help blockchain and crypto startups scale their businesses, Visa also launched its own Creator Program to mentor entrepreneurs about NFTs and support small businesses.

Putting their money where their mouth, in April 2022, Mastercard filed 15 NFT and metaverse trademark applications aimed to broaden its payment processing system into the new virtual economy. Another industry giant, American Express, aims to provide its real-world services in the world of the metaverse. The company is considering giving customers card payments, ATM services, banking services, and fraud detection in the metaverse. Amex also filed several patent applications and wants to trademark its logo for an online marketplace for buyers and sellers of NFTs.

One of the world's most extensive payment networks, Visa, joined the fray ahead of the other two in August 2021. Taking the first step into the metaverse, Visa spent $150,000 to buy a unique work of art. Instead of canvas or marble, the pixelated artwork is CryptoPunk 7610. Visa’s first NFT is an avatar of a female character, distinguishable by a mohawk, large green eyes, and bright red lipstick.

Empowering Employees

Ultimately, it is we humans who imagine, develop, and enjoy technological evolutions. Metaverse is one way to explore this statement. Since this upcoming technology is yet to emerge, bank training and skill development programs are already taking shape in the virtual world. The first one in the race is South Korea’s Hana Bank, which launched a special task force to foster businesses and attract younger customers in the virtual metaverse. The task force will review cooperation with local tech businesses, offering related services and seminars for its private banking customers, building online and offline metaverse platforms, and developing virtual reality-based financial services.

Further, Bank of America launched virtual reality (VR) training in nearly 4,300 financial centres. The training technology will allow approximately 50,000 employees to practice a range of routine to complex tasks and simulate client interactions through a virtual environment.

The metaverse opens new possibilities for leveraging digital learning solutions in broader ecosystems. As the physical and virtual realms coalesce, more immersive and collaborative ways of training and skill development mechanisms will emerge.

While the number of banks dipping their toes in the metaverse is limited, the trend is expected to gain steam with multiple consumer segments, industries, and governments joining the chorus. The initial banking experiments, which seem to be focused on setting up virtual branch offices for younger consumers and remote training and collaboration mechanisms for employees, may soon evolve to setting up financial products and infrastructure capabilities that will underpin the development of the metaverse economy and facilitate its interconnectedness with the physical and digital economies.

Metaverse Banking: Boisterous Branding or Blossoming Business

Digital transformation in banking is at its inflection point. On the one hand, much work is happening to embrace the realities and potential of digital channels and business models. On the other hand, the exciting opportunity of metaverse beckons the banking world to sit up and take notice.

While the early metaverse initiatives from banks may sound like boisterous branding attempts to maintain their tech-savvy positioning, the commercial opportunity of the metaverse economy is too substantial to ignore. Today we talk about the nature and needs of digital-native consumers and businesses and how it impacts the banking world. In the next 10-15 years, we will likely witness the nature and requirements of metaverse-native firms and consumers and the subsequent impact on banking.

Metaverse is a significant technology shift that has been embedding itself into our individual, social, and commercial lives. This presents an unprecedented opportunity for banks to be the first movers and leverage its potential magic to rebuild community and reignite conversations with their customers. It is an opportunity for banks to reimagine their brand identity and product portfolio to drive deep emotional and commercial engagement with metaverse-native consumers and businesses. The trillion-dollar metaverse pie is almost certainly going to materialise. The only question is the time it takes for the virtual world to become a reality for consumers and businesses at large. Which industry and which institution gets to take a slice of that pie is up for grabs!

A metaverse moment of truth is staring in the eyes of forward-looking enterprises. Are banks going to double down on the metaverse bets or tread safely amidst the impending economic slowdown? Keep your AR/VR Headsets on and enjoy the show!

And It’s A Wrap! 👏

Hope you enjoyed this edition of Fintersections! Stay tuned for more interesting think-pieces in the coming months.

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include exploring the Neobanking Failures and Setbacks and journeying through Revolut's Playbook to Build a Global Financial SuperApp

If you're someone who likes to stay in the know of what’s happening in FinTech, you don’t want to miss out on our weekly newsletters—Future of FinTech and Web3 Weekly Wonderland—where we religiously track next-gen themes of the industry.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for features, research content, or sponsorship-related services, reach out to us at hello@whitesight.net

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some 💛