Apple Opens Up To Open Banking

Disclaimer: The content of this webpage is not investment advice and does not constitute any offer or solicitation to recommend any investment product. It is for general education and information purposes only.

Kudos to Apple for acquiring Credit Kudos in the UK!

Apple has reportedly shelled out $150M for Credit Kudos, an open banking technology firm. This acquisition felt like a fitting event for FinTersection – a newsletter where we analyze the intersection of two sectors, industries, or business models – with at least one of them being FinTech.

New here? Read what Fintersections is all about here and click on subscribe to join the bandwagon of FinTech enthusiasts to get monthly think-pieces that make you go ‘oooh!’ right to your inbox 📨

Let’s go down the rabbit hole of the resultant phenomenon that has emerged at the intersection of BigTech and Open Banking.

Apple says hello 👋 to the Open Banking world. But wait, there’s more to Credit Kudos than just Open Banking.

What Does Credit Kudos Bring To The Table?

In addition to holding an AISP (Account Information Service Provider) license, they are also an FCA-regulated credit reference agency. And that gives them access to both open banking data and the credit data from banks that other traditional credit bureaus have access to. Being an AISP, Credit Kudos is also authorized to access an individual’s or SME's bank account data from their financial institutions with their explicit consent. Credit Kudos is also registered with the Information Commissioner’s Office as a Data Controller and is compliant with the UK’s Data Protection Act and the EU’s General Data Protection Regulation.

In addition to having access to banking data through open banking infrastructure providers, Credit Kudos has also built several value-added technology tools – such as data classification engine (Lotus), insights engine (Atlas), credit risk models, decision engine (Assembly), and other income and identity verification tools to improve and automate the credit-decisioning process. This credit-focused approach to Open Banking offers a significant hint on how Credit Kudos may be an essential cog in Apple’s Financial wheel that it seems to be eyeing to build for quite a few years now.

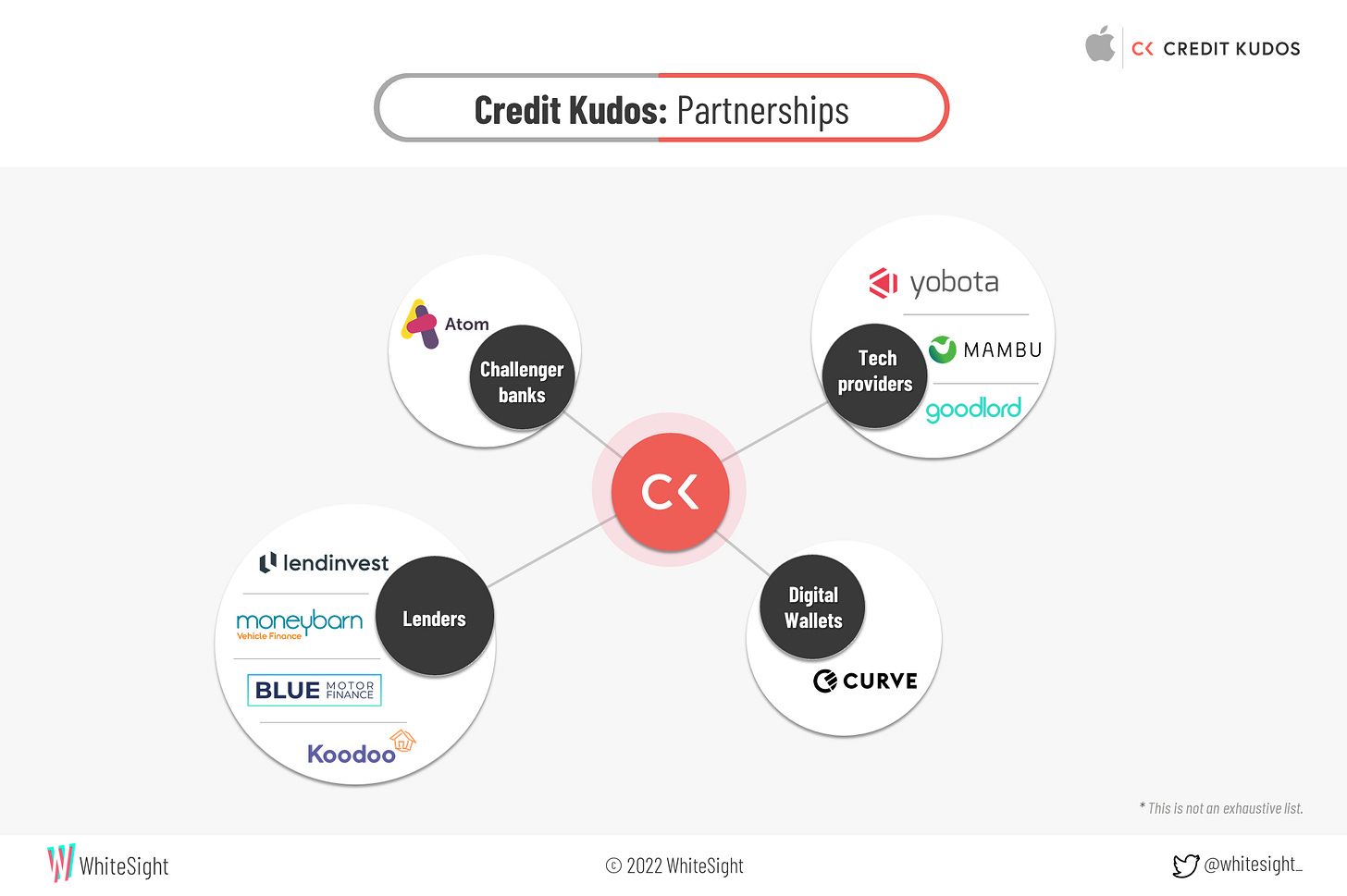

Besides the domain experts and tech talent that Credit Kudos brings to the table, its experience working with various players in the FinTech segment, including partnerships with over 100+ lenders, could also have played a key role in Apple’s acqui-hiring call. Over the years, Credit Kudos has partnered with challenger banks (Atom Bank), digital wallets (Curve), tech providers (Mambu, Yobota, Goodlord), lenders (LendInvest, Moneybarn, Blue, Koodoo), etc. to conceptualize, launch, and improve several credit products such as BNPL, mortgage finance, motor finance, business loans, etc.

Making Sense Of The Acquisition From Apple’s Lens

While coming up with the possible objectives of Apple’s acquisition, we considered several factors – such as affiliations with Apple's other business portfolio, its current FinTech play, competitors' initiatives, etc. The launch of BNPL in the short term and building a two-sided ecosystem with merchants and consumers, in the long run, seems to be the best bet.

Since 2014, with the launch of Apple Pay, Apple has given significant importance to payments from various angles. Globally, Apple Pay is now live in 70+ countries, the UK being the second country where it went live in July 2015, shortly after the 2014 launch in the USA. In the USA, Apple Pay has become a one-stop shop to support payments through Apple Cash card, Apple Card, and any other credit or debit card. Apple Pay isn't like contactless cards because it has an extra security feature called tokenization, which keeps the card info off of the retailer's hands. Instead, the payee receives a single-use 'token,' allowing them to debit the payment only once.

Apple has been flirting with Buy Now Pay Later (BNPL) for quite some time now. You can go through the details of their FinTech bets in one of our previous blogs. They have partnered with ZestMoney in India and Affirm and Paybright in Canada to launch BNPL for the purchase of Apple devices. In 2020, Zip, a BNPL player in Australia, partnered with Visa to offer the Tap and Go feature to all merchants where Visa is accepted. It also allowed its Zip card to be added to Apple Pay. The BNPL proposition makes even more sense from a consumer segment perspective, given its appeal among GenZ consumers. With the launch of BNPL, Apple may be able to get a toehold with GenZ customers’ payment journeys as the credit card penetration happens to be relatively lower in this segment. As to how Apple will launch the BNPL services to the market – the practical route would be to forge underwriting partnerships with regulated entities or with embedded finance platforms to share the credit risk and outsource the monitoring and collection activities.

Additionally, BNPL, specifically in the UK, is going through an identity crisis with the FCA actively reviewing the terms and conditions of the consumers' contracts. Several incumbent banks that have launched BNPL offerings and traditional credit reference agencies, such as Transunion, Experian, and Equifax, have started including BNPL payment history in their credit reports. Payment networks, such as Visa and Mastercard, have also made key acquisitions and partnerships to propel the BNPL rails' availability to merchants and retailers. In the current environment of diminishing merchant discount rates and rising interest rates, the BNPL industry is expected to go through a shake-up period, and Apple may play a significant role in how the sector transforms.

There are also significant themes emerging in the business loans category targeted at the creators’ economy and small-medium enterprises (SMEs) – with eCommerce firms such as Shopify, eBay, and other payment service providers partnering up with regulated lenders and embedded finance platforms to bring credit products in the form of merchant cash advance and business loans to this underserved segment. Apple will undoubtedly have a leg up in the part if they decide to build the credit propositions on top of the newly launched iPhone’s payment acceptance proposition for merchants.

Apple’s Ecosystem Play In Finance

In July 2021, it was also reported that Apple partnered with Goldman Sachs to launch its own BNPL called Apple Pay Later in the US. On the surface, it may appear that Apple Pay Later will compete with BNPL players Affirm and Klarna; however, we think that Apple's primary and formidable competitors in the FinTech-powered propositions are Amazon, PayPal, and Block (previously known as Square). We have already seen Apple’s move into Block’s territory earlier this year with the launch of the Tap to Pay on iPhone feature, a new way to allow merchants to accept contactless payments with no additional hardware.

Apple is known to compete with ecosystem propositions, and this acquisition of Credit Kudos can help it unlock significant synergies with both consumer and merchant ecosystems through credit propositions.

Another critical option for Apple to leverage this acquisition is to embed financial and lifestyle data to improve its core propositions around the devices and services it offers to customers and businesses. The high provenance economic behavior data could come in pretty handy in propelling Apple’s hardware subscription service through which it can lease the iPhone and other hardware products on subscription plans. Leasing iPhones instead of selling them traditionally could put a serious dent in the tech industry's current business model and help manage the growing mountain of e-waste due to customers upgrading their hardware every year. The leasing program could enable Apple to create an iPhone entirely sourced from recycled materials while convincing users to upgrade their phones every year.

Credit Kudos' current business model lies at another interesting intersection between Open Banking datasets and credit history datasets. It allows it to bring the power of Open Banking datasets to create viable credit propositions to assess the worthiness of thin-file customers who may not have any prior credit history. This overlap of datasets also improves the creditworthiness assessment process, thus reducing customer default rates. It is an ideal and vital piece for Apple, who would want to offer short-term and low-ticket credit products to underserved customer segments as they build their credit profile. The Apple Pay Later proposition would have significant synergies with Apple's core device business, reducing the affordability problem by converting the purchase price into installment loans.

Though significant from consumer and merchant standpoints, account-to-account payments seem unlikely to get a fillip with this acquisition. The Amazon and Visa showdown last year on credit card fees and Bank of America’s recent launch of Pay by Bank in partnership with Banked in the UK does highlight the potential of account-to-account payments emerging as an essential payment method in the future.

Credit Kudos does not hold a PISP (Payments Initiation Service Provider) license and has been primarily involved in data aggregation and enrichment for credit-related propositions. However, it does signal an attempt by Apple to bring all kinds of payment form factors in Apple Pay and could be enabled by either Credit Kudos procuring the PISP license or through an inorganic route.

Apple’s Fintech Warchest

Apple is a scary competitor. More importantly, it is also a master collaborator, as is evident from its financial services experiments done in partnership with a slew of players. Apple has collaborated with Green Dot to launch Apple Cash and Goldman Sachs to launch Apple Card. Earlier, it had teamed with Visa, Mastercard, American Express, and JPMorgan Chase for the launch of Apple Pay. Lately, it has partnered with Stripe and Shopify; and is using the technology from a previously-acquired firm Mobeewave to launch the contactless payment acceptance for merchants.

The art of creating, managing, and growing collaborations is a necessary trait to be successful in Open Banking and Open Finance propositions. With the acquisition of Credit Kudos, Apple may unlock several layers of network effects, as Credit Kudos is already connected with several UK banks for data aggregation and a diverse set of FinTechs who use its services for creditworthiness assessment-related activities. With the Open Banking rulebooks currently being a work in progress in the US, it presents an opportunity for Apple to use Credit Kudos’ technical and domain expertise to get a pole position in the US as the industry adopts interoperability standards and other regulatory mandates.

Apple’s Leapfrog Moment In FinTech

Contrary to popular belief, Apple is not usually known for being the first in what they do. Instead, Apple is known for being the best at what they do. That results in the massive creative destruction of seemingly robust business models, as we have witnessed in the cellphone, music, and several other industries. They were not the first to launch a smartphone. Not the first to launch a portable music device. Indeed, not the first to launch a numberless card and a digital wallet. Ironically, the hardwareless, contactless payment acceptance was launched by Samsung Pay in the form of mPOS in partnership with Mobeewave in 2019. Soon after, Mobeewave got acquired by Apple in 2020. Two years later, they have brought forth payment acceptance to merchants through iPhone devices encroaching the space that Square created since the launch of Square reader in 2009.

Apple seems well suited to catapult itself in the two-sided ecosystem proposition for consumers and merchants. Block won’t be a pushover with Jack Dorsey at its helm with undivided attention. However, this may have a rug pull effect on Block’s traditional business model, which has been perfected over the last decade. It will be interesting to watch a counterpunch response from Block to defend its massively successful platform business and whether it can keep its focus on the ever-enticing web3 projects simultaneously! But Block has an experience of surviving the onslaught from a BigTech before. It did manage to fend off Amazon’s attempts to disrupt the status quo when it launched a card reader in 2014 to take on Square directly. Its defense was premised upon the fact that it was deeply integrated with several aspects of the business and operated differently from traditional point-of-sale companies, a phenomenon that Jim McKelvey – the co-founder of Square called an ‘innovation stack.’ So, it will be interesting to see the industry response to Apple’s attempt to reengineer the dynamics of consumer-merchant payments.

Nevertheless, this acquisition may emerge as one of the most critical inflection points for Open banking and Open Finance, given Apple's possibilities and potentials at its disposal with Credit Kudos. With the privacy-preserving techniques that Apple seems to have perfected over the years – at least in customers' minds – it can boost consumer confidence for Open Banking. It may also help increase acceptance among the masses for the consent-driven data sharing mechanisms to access better financial and lifestyle products.

And, well, even more FinTech acquisitions from Apple could be on the cards (pun intended) as it attempts to expand and perfect its FinTech war-chest and transform its current business model to a FinTech-powered one.

And It’s A Wrap! 👏

Hope you enjoyed this edition of Fintersections! Stay tuned for more interesting think-pieces in the coming months.

If you're hungry for more FinTech insights, check out some of our other work at WhiteSight.

Our latest publications include taking a closer look at Open Banking Innovation in Saudi Arabia in partnership with Mod5r, exploring the Intricacies of Open Banking Use Cases for the MENA Region in collaboration with Spire, and entering the immersive universe of Gamification—Into The Metaverse.

If you're someone who likes to stay in the know of what’s happening in FinTech, you don’t want to miss out on our weekly newsletters—Future of FinTech and Future of Crypto—where we religiously track next-gen themes of the industry.

FinTech research is in the WhiteSight DNA, so if you'd like to get in touch for our strategic intelligence and research content services, reach out to us at hello@whitesight.net

And lastly, to stay updated on everything FinTech, follow us on LinkedIn and Twitter and don't be shy to show some 💛